China’s steel, metals sector calls for retaliation over Trump tariffs

Industry associations say government should impose levies on US imports, including consumer electronics and luxury goods

Chinese industry groups and researchers on Friday called on the government to retaliate against the United States after Washington slapped heavy tariffs on steel and aluminium imports and reportedly pressured Beijing to substantially cut the trade surplus.

The China Iron and Steel Association and the China Nonferrous Metals Industry Association said in separate statements that the government should take countermeasures against US products.

The penalties should cover steel, coal, agriculture, consumer electronics, recycled aluminium and luxury consumer goods, the statements said.

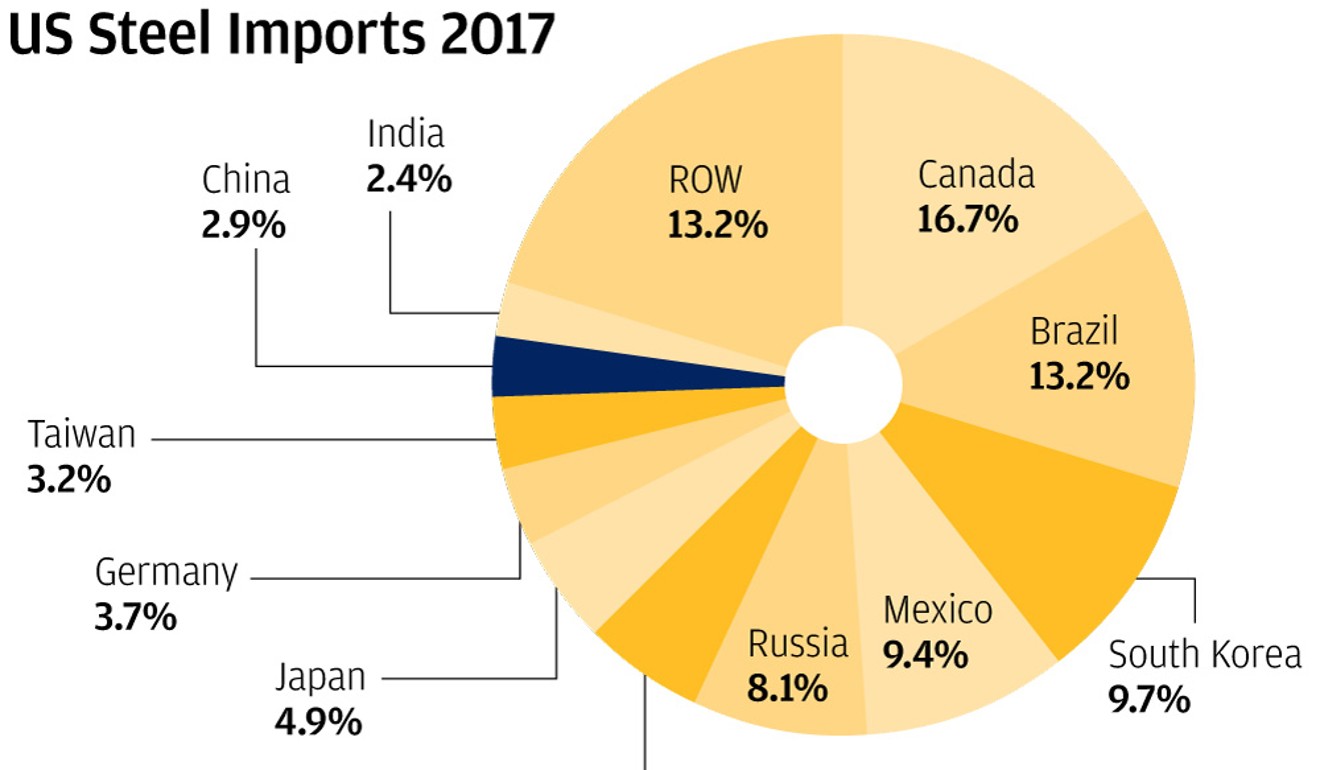

The move has sparked warnings of a trade war with China and US allies in Europe, but Canada – which supplies 41 per cent of US steel imports – and Mexico are exempted from the tariffs.

Wang Hejun, head of the trade remedy and investigation bureau at China’s Ministry of Commerce, said on Friday that most US steel and aluminium imports were for civilian use and the US move was trade protectionism under the guise of national security.

“The US has abused the ‘national security exemption’ clause, which causes reckless damage to the multilateral trade system represented by the World Trade Organisation and is set to deal a heavy blow to the normal global trade order. China firmly opposes this,” Wang said.

Never mind China, could Trump country be hardest hit by tariffs?

“China will take forceful measures, after assessing its losses from the US measure, to firmly defend its reasonable interests,” he said.

Wang called on the US to respect the authority of the international trade system and revoke the measures.

China supplies less than one-tenth of the US’ steel and aluminium imports, but Lu Xiang, a US specialist with the Chinese Academy of Social Sciences, said Trump’s decision was a “very bad” sign indicating that the situation could worsen.

The China Iron and Steel Association said the move would draw a global backlash. “Trump’s behaviour is a challenge to the global steel industry and will definitely encounter opposition from more countries,” the industry group said.

China’s Foreign Minister Wang Yi on Thursday accused the US of using the “wrong remedy” to tackle trade disputes and vowed to take action.

Trump has repeatedly accused Beijing of adopting trade practices which unfairly penalise US firms, boosting America’s trade deficit with China.

A US government investigation is also under way into claims of widespread theft of American companies’ intellectual property by Chinese firms, and the Trump administration may launch further trade sanctions against China in the coming weeks.

“China should fire back with a tit-for-tat response. If Trump imposes sanctions following the findings of the Section 301 investigation into China’s intellectual property practices, that could start an all-out trade war,” Lu said.

The Wall Street Journal reported on Thursday that the US had pressured China to cut its trade surplus with the US by US$100 billion a year when top economic adviser Liu He went to Washington last week. That amount was one-third of China’s trade surplus with the US last year.

He Weiwen, a former counsellor at the Chinese consulate in New York, said trade surpluses or deficits were the result of business activities along the global value chain and it was not the government’s responsibility.

“Tensions are rising and China must take countermeasures,” He said. “We must fight back, while also seeking a solution through talks with Washington and continuing trade and investment cooperation with local governments.”

Lu said the government could also take action by encouraging businesses to boost imports from the United States to narrow the surplus.